As an economist, I have been always more interested in using some traditional models to study and understand the digital world around us.

I will never forget the advice from Roberto Aguiari, my professor at Business Economic Course: “Economics rules never change!”.

He was right… maybe!

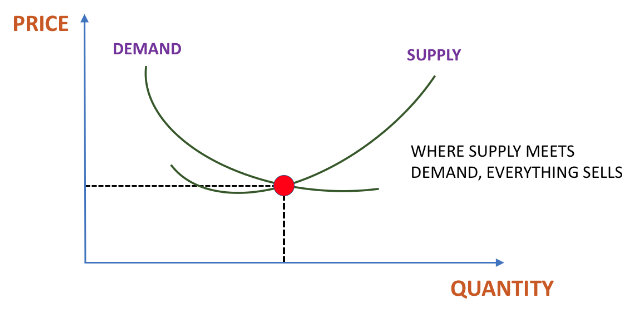

More than 200 years ago, Adam Smith wrote: “Price is regulated by the proportion between the quantity brought to market and the demand of those who are willing to pay.”. For all the new metrics created and proffered by digital media and advertising companies since the industry’s origin in the mid-1990s, Smith’s principle remains intact. Indeed, in the Online Advertising Market, the CPM or Cost Per Thousand Impressions, represents the equilibrium at which, in a free market, all available supply would sell, as you can see in the following image, just in the intersection of the downward sloping demand curve and the upward sloping supply curve.

Given this classic economic paradigm – along with demand clearly growing as more ad euros shift online and the industry’s constant endeavors to increase the value of its ad inventory through improved targeting, more effective measurements and new ad formats – CPMs should be increasing.

But this is not happening.

I spent quite a bit of time thinking about it. It was not so clear to me the reason of it.

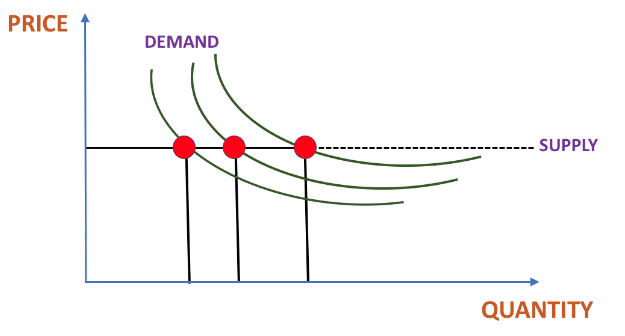

Probably, it is because of Smith’s principle implicitly assumes that supply at a given price is limited, and that the cost of an additional unit of output becomes higher as the total supply expands. A good example of this phenomenon is the golden market. To deliver more quantity, additional drilling in mines is required.

On the contrary, in digital media, the marginal cost of adding new programming or advertising inventory is very low, and has been trending lower for years, as the costs of computer processing and storage have plummeted. Whereas adding new pages to a magazine incurs substantial material, production, and distribution costs, generating new Page Views and attendant ad inventory online costs almost nothing. In such a case, supply could be infinite as long as the price exceeds the marginal cost per unit. An increase in demand, as implied by a shift of the demand curve to the right, does not increase price. In fact, price remains constant at any level of demand, and efforts to increase demand do not create a supply imbalance and associated price increase.

Food for thoughts…

Update: We are now living the NFTs (Non-Fungible Token) revolution, where the digital assets are slowly getting back under de Adam Smith’s law.